What is Bookkeeping? How to become a Bookkeeper in Canada?

2024-06-20 2024-06-21 17:55What is Bookkeeping? How to become a Bookkeeper in Canada?

What is Bookkeeping? How to become a Bookkeeper in Canada?

Are you a student wondering about job prospects after graduation? Consider bookkeeping!

In Canada, there were approximately 237,900 bookkeepers, accounting, and related clerks employed in 2020, and this number is expected to increase to about 245,400 by 2024. Whether you’re eyeing a stable career path or aiming for employment right after graduation, bookkeeping offers a lucrative opportunity.

So, what is bookkeeping? Let’s dive into this blog and explore a bookkeeper’s job description, the salary of a bookkeeper in Canada, and the ins and outs of this in-demand profession. We’ll also guide you on how to become a bookkeeper in Canada and kickstart your journey to a fulfilling career.

Table of Contents

ToggleWhat Is Bookkeeping?

Definition of Bookkeeping

The bookkeeping meaning refers to the systematic recording, organizing, and maintaining of financial transactions for a business. It is a critical component of financial management, ensuring that all financial data is accurate and up-to-date. This accuracy is essential for informed decision-making, effective budgeting, and strategic planning.

Effective bookkeeping helps businesses track income and expenses, maintain cash flow, and comply with tax regulations.

History of Bookkeeping

The history of bookkeeping dates back to ancient civilizations such as Mesopotamia, Egypt, and Greece, where scribes documented trade, taxes, and economic activities on clay tablets and papyrus scrolls.

In Mesopotamia, around 3300-3200 BCE, Sumerians used clay tablets to record transactions involving goods like livestock and grains, serving as both economic records and legal documentation. In ancient Egypt, ‘scribes of the house of life’ recorded temple finances, agricultural production, and taxes on papyrus.

During the Middle Ages, European bookkeeping evolved with Italian merchants in cities like Venice and Florence developing double-entry bookkeeping. The Industrial Revolution in the 18th and 19th centuries further standardized bookkeeping and made it integral to business operations.

In the 20th century, technological advancements, especially computers and accounting software, transformed bookkeeping from manual ledgers to digital spreadsheets and automated systems, streamlining financial reporting and enhancing data analysis capabilities. Today, bookkeeping remains essential to business and financial management, with modern tools enhancing accuracy, transparency, and accountability.

What Does a Bookkeeper Do?

What is a bookkeeper?

The role of bookkeepers is essential for maintaining a business’s financial health by handling key bookkeeping duties.

According to Job Bank Canada, employment growth for accounting technicians and bookkeepers is projected to be moderate, with around 39,000 job openings expected from 2022 to 2031. This demand highlights the important role bookkeepers play in maintaining the financial health and efficiency of businesses in Canada.

Bookkeeper’s Job Duties

Here are some of a bookkeeper’s duties and responsibilities commonly listed in a bookkeeper’s job description:

- Recording Financial Transactions: Meticulously records all financial transactions, ensuring every sale, purchase, receipt, and payment is accurately documented.

- Categorizing Transactions: Sorting transactions into specific accounts like assets, liabilities, and expenses for easier financial tracking.

- Reconciling Accounts: Comparing internal records with bank statements to identify and correct discrepancies.

- Preparing Financial Reports: Creating initial reports, such as income statements and balance sheets, to provide a snapshot of the business’s financial status.

- Managing Payroll: Ensuring employees are paid correctly and on time.

- Tax Preparation: They assist in preparing financial records and documents for tax filings, ensuring compliance with tax regulations and maximizing deductions.

- Budgeting and Forecasting: Depending on their experience, some bookkeepers may assist in budgeting and forecasting activities, providing valuable financial insights to support strategic planning and decision-making.

These tasks collectively ensure accurate financial records, support compliance with tax regulations, and aid in strategic financial planning.

Bookkeeping Salary in Canada

In Canada, Bookkeeper salaries vary by province, with some areas paying Bookkeepers more than others. According to Indeed, the average pay for a bookkeeper is $26.81 per hour in British Columbia and $26.56 per hour across Canada.

You may also take reference from the Government of Canada 2023 for detailed data:

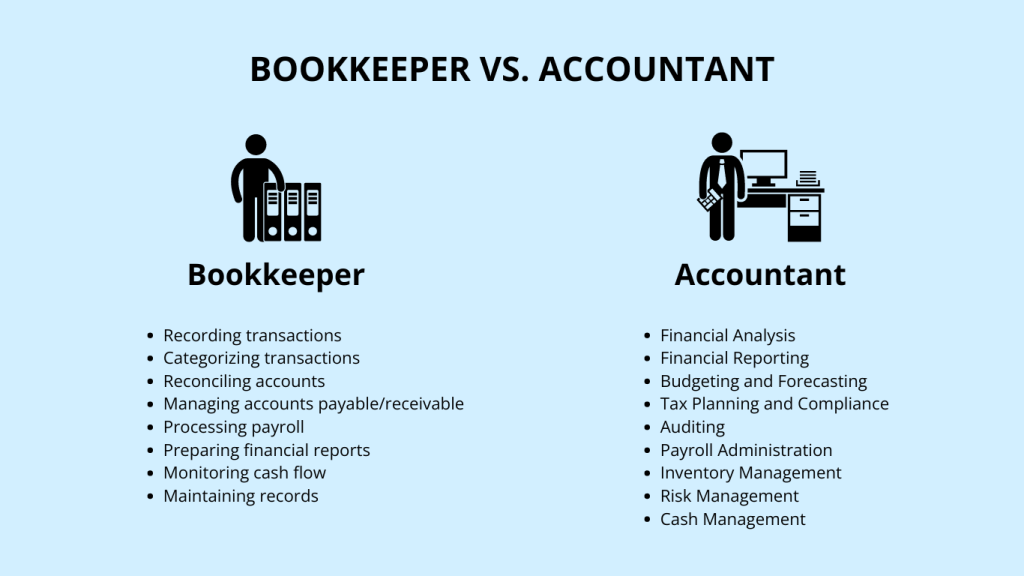

Bookkeeping vs Accounting: What are the differences?

“Is bookkeeping the same as accounting?”

People often confuse bookkeeping and accounting because both are crucial in financial management. In some small to medium-sized companies, these roles overlap, sometimes performed by one person because bookkeeping is part of the accounting process.

However, they are distinct jobs, and as a company scales, the differences become clearer. The biggest difference is that bookkeeping involves storing day-to-day financial records. A bookkeeper may or may not need a license but can acquire relevant professional certifications.

Meanwhile, accounting involves tasks after bookkeeping. An accountant’s role focuses less on record-keeping and more on synthesizing financial details from bookkeeping, analyzing, interpreting, reporting, and providing effective financial planning advice for the company’s leadership. An accountant needs to acquire licenses like Certified Public Accountant (CPA) and other professional accounting certifications.

Aspect | Bookkeeping | Accounting |

Focus | Limited to recording daily transactions | Provide big-picture insights: interpreting, classifying, and analyzing financial data |

Responsibility | Bookkeepers handle day-to-day transactions | Accountants oversee overall financial management |

Tasks | Recording transactions, reconciling accounts | Financial analysis, budgeting, forecasting |

Decision-making | Provides data for decision-making | Analyzes data to guide strategic decisions |

Legal Requirement | Not legally required, but recommended | Often required for legal compliance and audits |

Regulatory Compliance | Basic compliance (e.g., tax filing requirements) |

How To Become A Bookkeeper? Get Training in Bookkeeping!

Bookkeeping Certifications

Acquiring reputable bookkeeping certifications can greatly boost your career prospects. Some trusted bookkeeping certificates often pursued by professionals include:

- Certified Bookkeeper from the American Institute of Professional Bookkeepers (AIPB)

- Certified Public Bookkeeper from the National Association of Certified Public Bookkeepers (NACPB).

- Certified Professional Bookkeepers of Certified Professional Bookkeepers of Canada (CPB Canada)

These certifications typically require passing exams that cover essential bookkeeping tasks, including adjusting entries, payroll, depreciation, and inventory management.

Bookkeeping certifications demonstrate your commitment to the profession and can make you more attractive to employers, potentially leading to higher pay and better job opportunities. According to Payscale, certified bookkeepers in Canada can earn up to 10% more than their non-certified counterparts, reflecting the value of certification in this field.

Additionally, some certifications require continuing education, helping you stay current with industry standards and practices. This ongoing learning can be invaluable as accounting regulations and software frequently evolve.

Diploma Programs in Bookkeeping

In Canada, 68% of job postings for bookkeeping roles require candidates to have a post-secondary education, with 32% specifically requesting an undergraduate degree.

Moreover, 82% of employers prefer candidates with formal education when hiring for bookkeeping positions. With advanced education, professionals in bookkeeping can access higher-paying roles and are more likely to secure promotions.

At Create Career College (CCC), we recognize the importance of obtaining an undergraduate degree in business administration or accounting to establish a solid groundwork for a thriving career in bookkeeping.

As a Designated Learning Institution (DLI), CCC’s programs provide students with the necessary skills and knowledge to excel in their chosen field. To become a bookkeeper, students can consider 2 program choices:

Professional Bookkeeping Diploma Program in Vancouver BC

Business Administration Diploma (2 Years with Co-op Program)

The Business Administration Diploma program offers a comprehensive curriculum that covers essential business principles, financial management techniques, and organizational strategies.

The BA program emphasizes the importance of effective communication, problem-solving, and decision-making skills, all of which are invaluable in the field of bookkeeping. Graduates emerge equipped with a strong understanding of business operations and financial concepts, positioning them for success in the competitive job market.

Accounting Diploma (2 Years with Co-op Program)

In the Accounting Diploma program, students learn everything about accounting, from basic principles to tax rules. Through practical exercises and real-life scenarios, they become skilled in using accounting software, creating financial reports, and following ethical guidelines.

The program focuses on being accurate and paying close attention to details, which are important qualities for bookkeepers. After finishing the accounting program, graduates have a solid grasp of accounting concepts and are ready to tackle the challenges of the financial world confidently.

Bookkeeping Internship & Co-op Placement

Graduates often face challenges when seeking entry-level positions after graduation, as employers typically require at least one year of experience for roles like Entry Level or Junior. The solution lies in Internship courses or Co-op Programs offered at colleges.

Gaining practical experience through internships and cooperative placements is invaluable for aspiring bookkeepers. These opportunities allow students to apply classroom knowledge in real-world settings, enhancing their skills and understanding of bookkeeping practices.

Employers highly value practical experience, often preferring candidates who have demonstrated their ability to perform bookkeeping tasks in a professional setting. Internships and cooperative placements not only enhance resumes but also build professional networks, crucial for job placement after graduation.

The Accounting or Business Administration Diploma programs at Create Career College offer Co-op Programs with major companies like Phantom Manufacturing and Accent Inns, providing students with 48 weeks of full-time work experience. This enables students to meet the experience requirements of the Canadian job market upon graduation.

In this blog, you’ve discovered the answer to the question, ‘What is Bookkeeping?’

If you’re a student aiming for a solid career path after graduation, consider becoming a bookkeeper. With Canada’s growing demand for skilled professionals in this field, gaining solid professional knowledge and practical experience through internships or Co-op Programs is key.

Getting bookkeeping certification in Canada, like becoming a Certified Bookkeeper, boosts your credibility and earning potential. Plus, pursuing a degree in Business Administration or Accounting opens doors to better opportunities.

At Create Career College, our Co-op Programs provide real-world experience and networking chances. Start your journey now and build a rewarding career in bookkeeping!

Bookkeeping Career in Canada FAQ

Recording financial transactions, categorizing expenses and income, reconciling accounts, preparing financial reports, and managing payroll.

Obtain relevant education (such as a diploma or certification in bookkeeping), gain practical experience through internships or Co-op Programs, and consider obtaining professional certifications like Certified Bookkeeper.

Enroll in accredited bookkeeping courses or programs, gain hands-on experience through practical training such as co-op, and stay updated with industry standards and software.

Courses offered by recognized institutions like Create Career College in Vancouver BC, focusing on comprehensive curriculum, practical experience, and opportunities for professional certifications, are highly regarded.

—————————————–

Related articles:

- Visitor Visa to Study Permit: Come to Canada as a Mature Student

- Future Jobs in Business Administration

- Change Your Career by Pursuing an Accounting Diploma Co-op Program in 2024

- Discover CCC’s NEW ESL CLASS 2024: Elevating Excellence in English Language Schools in Vancouver

—————————————–

Related Posts

Is Digital Marketing a Good Career in Canada? 2024 Updated

Working in Canada as an International Student in 2024: What You Need to Know

Learning English in Vancouver 2024: Boost Your English for a Working Holiday in Canada

Search

Categories

- Is Digital Marketing a Good Career in Canada? 2024 Updated

- What is Bookkeeping? How to become a Bookkeeper in Canada?

- 2024年 一文看清PGWP未來更新動向 三分鐘了解台灣學生新出路

- Working in Canada as an International Student in 2024: What You Need to Know

- May 2024 Updates on Canada Hong Kong Pathway: Special Open Work Permit Policy to Extend Stay | Secure Jobs While Waiting for Your PR