Here is everything about the international student tax return in 2023.

It is now officially “Tax Season 2023” in Vancouver, Canada! This year’s tax return 2023 deadline has changed! According to the Canada Revenue Agency (CRA), Canadians, permanent residents, workers, and international students who had income in 2022 are required to submit their tax filing by 30 April 2023. The Canadian tax year runs from January to December annually.

But did you know, international students are welcome to file a tax return in Canada even though they have no income at all? It could really help international students save more money especially when they have already paid loads for tuition. Some international students might even file taxes because they have their Co-op! However, for new international students in Canada, tax filing could be daunting!

When is the international student tax return 2023 deadline? What documents are required in tax filing? Am I eligible for a tax return in 2023? Where should I file a tax return? What tax forms should I fill in? What to do if I have missed the tax return 2023 deadline?

No worries. This article will guide you through tax filing and tax returns as an international student in Vancouver, Canada.

Table of Contents

Why Should I File Taxes?

Filing taxes is not mandatory for international students in Canada in 2023. However, it is encouraged to file one because you will be able to set up a record for obtaining different benefits like Child Benefits or GST credits, or maybe you simply want to claim a refund. As an international student, a tax refund could save you a lot of money after paying tones for tuition. Thus, you should consider filing taxes for the first time before the tax return deadline this year!

Required Documents For Filing Tax Return 2023

If you are an international student in Canada, make sure you have the following documents ready before filing your tax:

- Social Insurance Number (SIN) / Individual Tax Number (ITN)

- Income tax slips – T4 or T4A for taxable scholarships, fellowships, bursaries, and artists’ project grants

- Interest tax slips – T3 or T5 which you could obtain from your financial institution

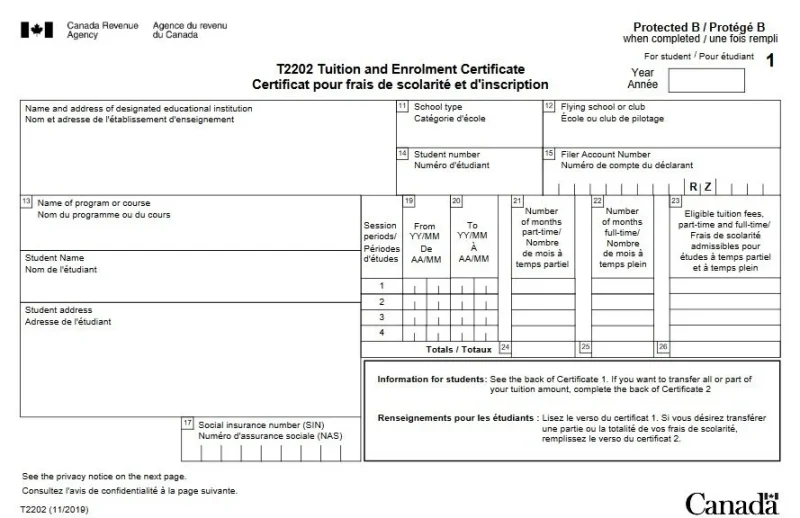

- Tuition receipt – T2202 Tuition and Enrolment Certificate which indicates the total tuition paid and the number of months you have attended school. This document should be provided by your attended education institution.

If applicable, please provide the following documents as well:

- Donation slip if you have donated to a charity in Canada

- Medical receipts that mark your medical expenses if you have paid out of your own financial reserves.

- Rent receipts if you do not live in a campus dormitory. Please obtain a copy from your landlord.

- Any correlated documents from the CRA if you have ever filed tax in Canada in the past

- Any slips or receipts that have indicated your income tax return in Canada

Students could complete the tax return process with the documents mentioned above on their own or hire an accounting professional or tax preparer to complete the tax return.

International Student Tax Credit

In Canada, students who are enrolled at a qualifying educational institution, are eligible to claim a federal tax credit which is equivalent to 15% of their eligible tuition and fees. Noted that the tuition fees have exceeded CAD100 in total.

Examples of non-refundable tax credits include:

- Employment amount

- Student loan interest

- Tuition fee

- Textbook amounts

GST/HST Credit For First-Year Residents

First-year Canadian residents, including international students, could enjoy tax benefits by applying for GST/HST credit. GST and HST are the taxes we have to pay when we purchase goods and services in Canada. Every quarter, the Canadian government will give out GST/HST credit to individuals who have low or no income to offset the financial burden as a newcomer.

If you are a first-year international student, you could apply for GST/HST credit while you do your tax filing. All you need to fill out Form RC151. You could also estimate your credit amount through the Child and family benefits calculator.

Where To Get The T2202 Tuition and Enrolment Certificate?

T2202 is one of the key documents that students need to prepare during tax filing. From 2019 onwards, T2202 has replaced Forms T2202A and TL11B. According to the policy of CRA, every designated educational institution (DEI) in Canada has to file T2202 and distribute the certificate electronically to every qualifying student. Thus, if you do not have the T2202 certificate, make sure you ask your enrolled institution for this document.

According to CRA’s definition, Create Career College is one of the Canada designated educational institutions; thus, qualified students from Create Career College shall receive their own T2202 certificate on or before February each year.

Where Do International Students File Tax Return?

Students may file their taxes through paper forms or online. Currently, there are many tax software on the market that facilitate the electronic tax filing process. Do some research on the software that you may select and make sure it is certified by the CRA. CRA has also recommended a list of paid or free tax software programs that you could use safely.

If you file your tax electronically, you should open a CRA account before you file your tax. Also, you may ready your SIN number as you will be required to provide your SIN number during the registration process.

What Is The Final Step of Tax Filing In 2023?

After all the preparation and hard work, once you submit your tax filing, the CRA will start processing your documents and undergo assessments. Your tax return process will be marked as three stages: “Accepted”, “Refund approved” and “Refund sent”. All tax filers will receive a Notice of Assessment (NOA) which evaluates their tax return after the tax return 2023 deadline.

On your NOA, you will be able to find the following information:

- The date that CRA assessed your tax return

- The particulars of how much you owe or how much you have for refund/credit

- Registered Retirement Savings Plan (RRSP) deduction limit of the year

Notice of Assessment is a significant document for your future taxation process. Please make sure you keep your NOA safely and securely with your tax records.

When Will International Students Receive Their Tax Refund?

Depending on the method you use to file your tax, the date of receiving a tax refund will be different.

According to the CRA, for the tax return 2023 deadline, they aim to transfer tax refund:

- Within 2 weeks if you file electronically or online

- Within 8 weeks if you file through a paper form

When Is The International Student Tax Return 2023 Deadline?

The key dates for Canada’s tax season in 2023::

- Start date of tax filing: Feb 20, 2023

- Deadline to tax filing: May 1, 2023

- Deadline to tax filing if you/your spouse/common-law partner are self-employed: June 15, 2023

The payment date for taxes in 2022:

- Deadline to tax payment: May 1, 2023

If you have missed the tax return 2023 deadline, you may still file taxes. However, all returns will be charged with a penalty of 5% of the entire balance. So, remember not to miss the tax return 2023 deadline!

(Fun Facts: Here in Canada, the annual tax filing date is April 30. However, in 2023, April 30 is a Sunday; thus, the date has been changed to May 1, 2023.)

Internationa Student Tax Return: FAQs

Yes, you are a resident of Canada. According to the Government of Canada, as long as you have established residential ties in Canada, you have become a significant resident of Canada. Residential ties include a home in Canada.

Some international students may not have a SIN number. You could complete Form T1261 to obtain an Individual Tax Number (ITN). Individual Tax Number is for non-residents.

Your social insurance number is highly confidential to identify your tax identity. It could be used for income tax reporting purposes. You must provide your SIN number while filing for your tax return in Can or when you are completing your tax documents (e.g. T3, T4, or T5 slips). However, do not hand out your SIN number to anyone!